Unlocking Home Buying Success: Prequalified vs Preapproved Explained

Understanding Mortgage Prequalification and Preapproval

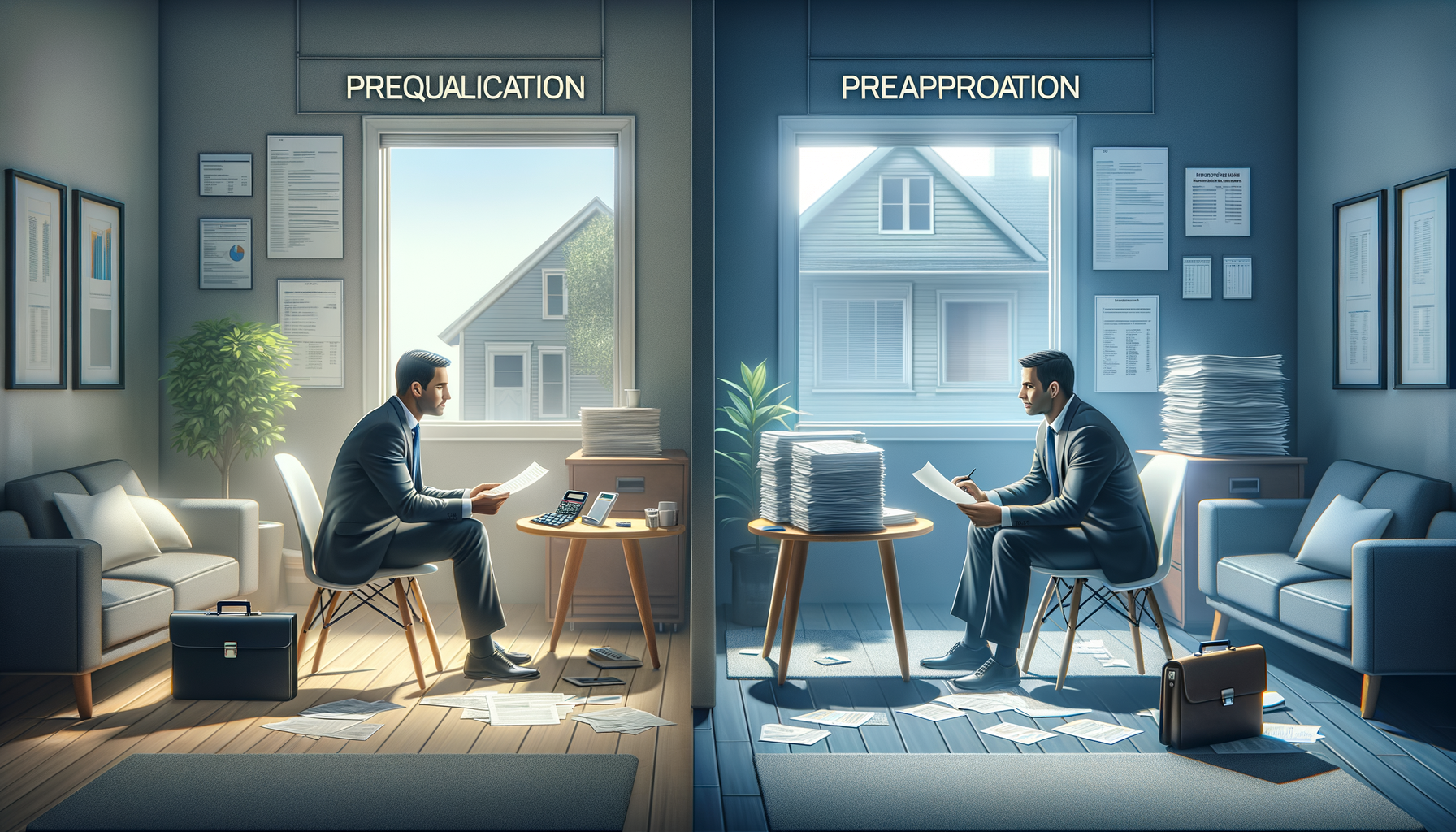

Embarking on the journey to homeownership can be exciting, yet navigating the financial aspects is crucial. Two key terms often arise during this process: prequalification and preapproval. Understanding the differences between them can empower you as a buyer.

What is Prequalification?

Prequalification is an initial step where a lender provides an estimate of how much you might be eligible to borrow based on your financial situation. It’s usually a straightforward process:

- Provide basic financial information.

- Lender gives a rough loan estimate.

- No credit check is typically performed.

This process gives you a general idea of your budget but doesn’t hold much weight with sellers.

What is Preapproval?

Preapproval is a more involved process that gives you a clearer picture of your borrowing capacity:

- Submit a detailed application.

- Provide documentation like pay stubs, tax returns, and bank statements.

- Lender conducts a thorough credit check.

- Receive a conditional commitment for a loan amount.

Prequalification vs. Preapproval: Quick Comparison

- Prequalification: Quick, no credit check, estimate based on self-reported information.

- Preapproval: Detailed, includes credit check, conditional loan offer.

“A preapproval letter can significantly strengthen your offer in a competitive market.”

Why It Matters

Having a preapproval can streamline the home-buying process, making you more attractive to sellers and potentially speeding up closing times. On the other hand, prequalification is a helpful starting point for understanding your financial standing.

Next Steps

- Assess your financial situation.

- Decide whether to start with prequalification or seek preapproval.

- Gather necessary documentation for preapproval if you choose to proceed.

- Connect with a reputable lender to begin the process.

By clearly understanding these processes, you can approach the home-buying journey with confidence and clarity.