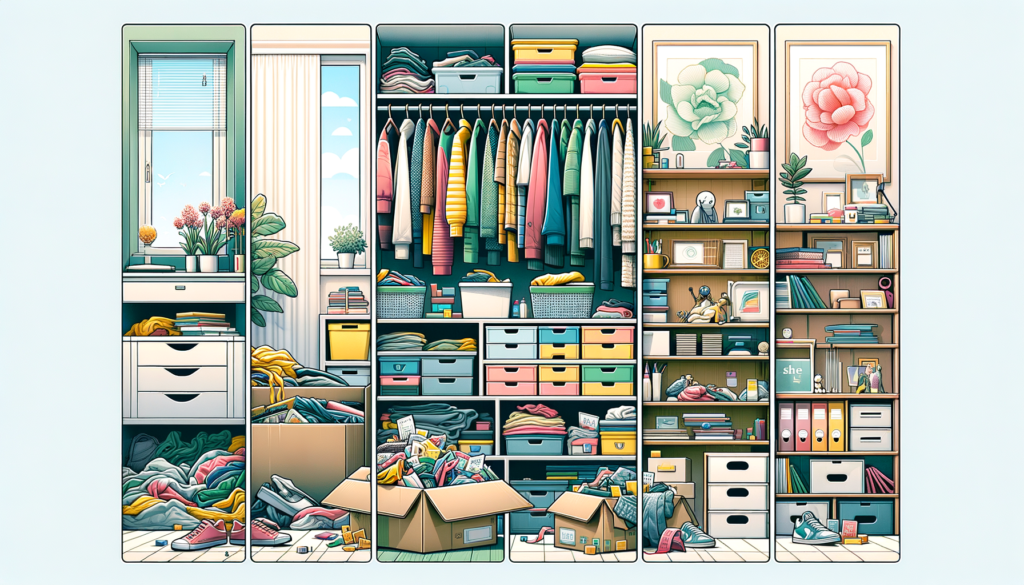

“Maximizing Space: 5 Innovative Storage Solutions for Compact Kitchens from Instagram”

Maximize your small kitchen’s potential by incorporating stylish and practical storage solutions that are currently trending on Instagram. The article “Chic Meets Neat: Instagram Showcases 5 Clever Storage Ideas for Compact Kitchens” highlighted these actionable tips that can transform your limited kitchen space into a functional and appealing area.