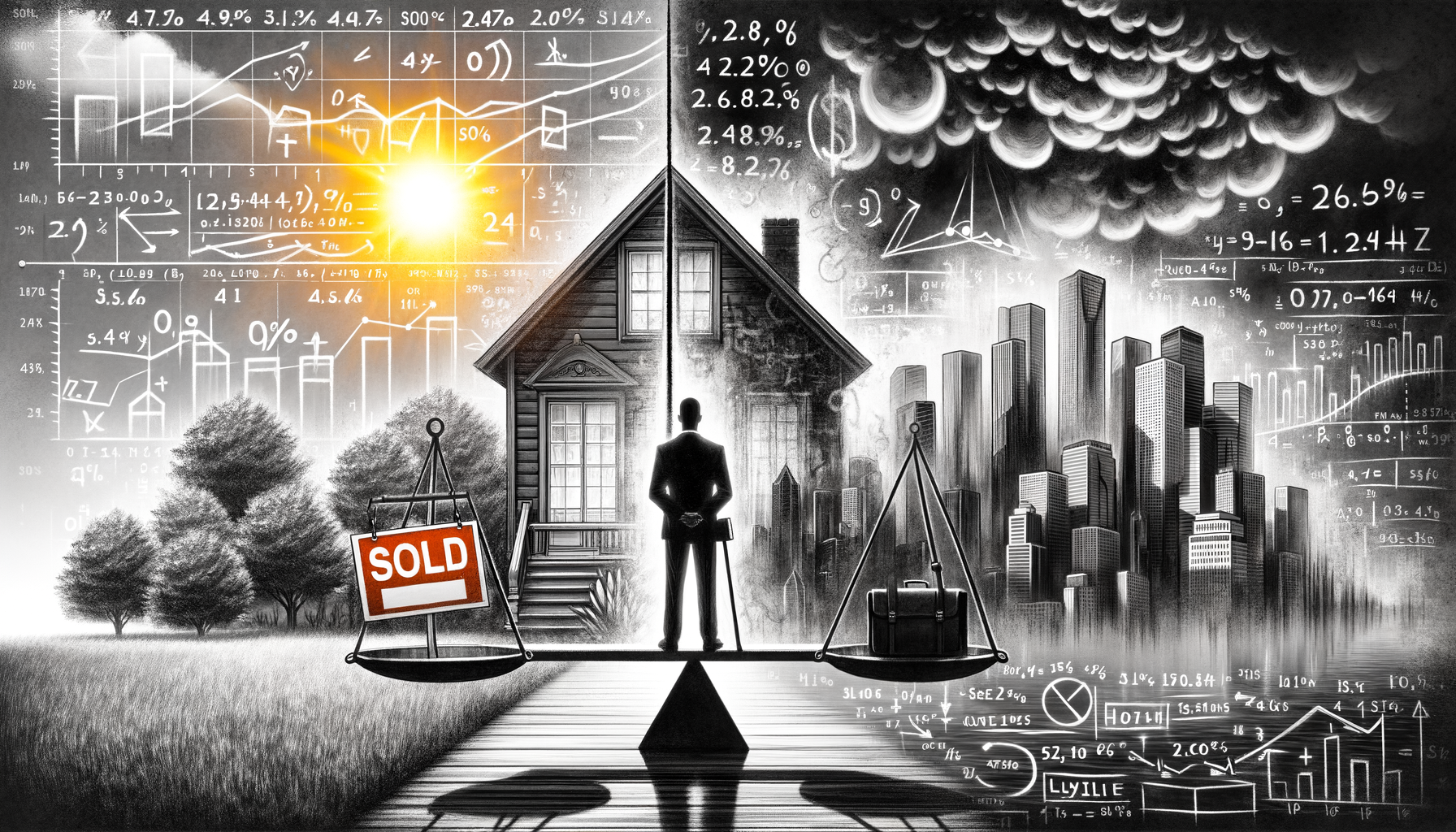

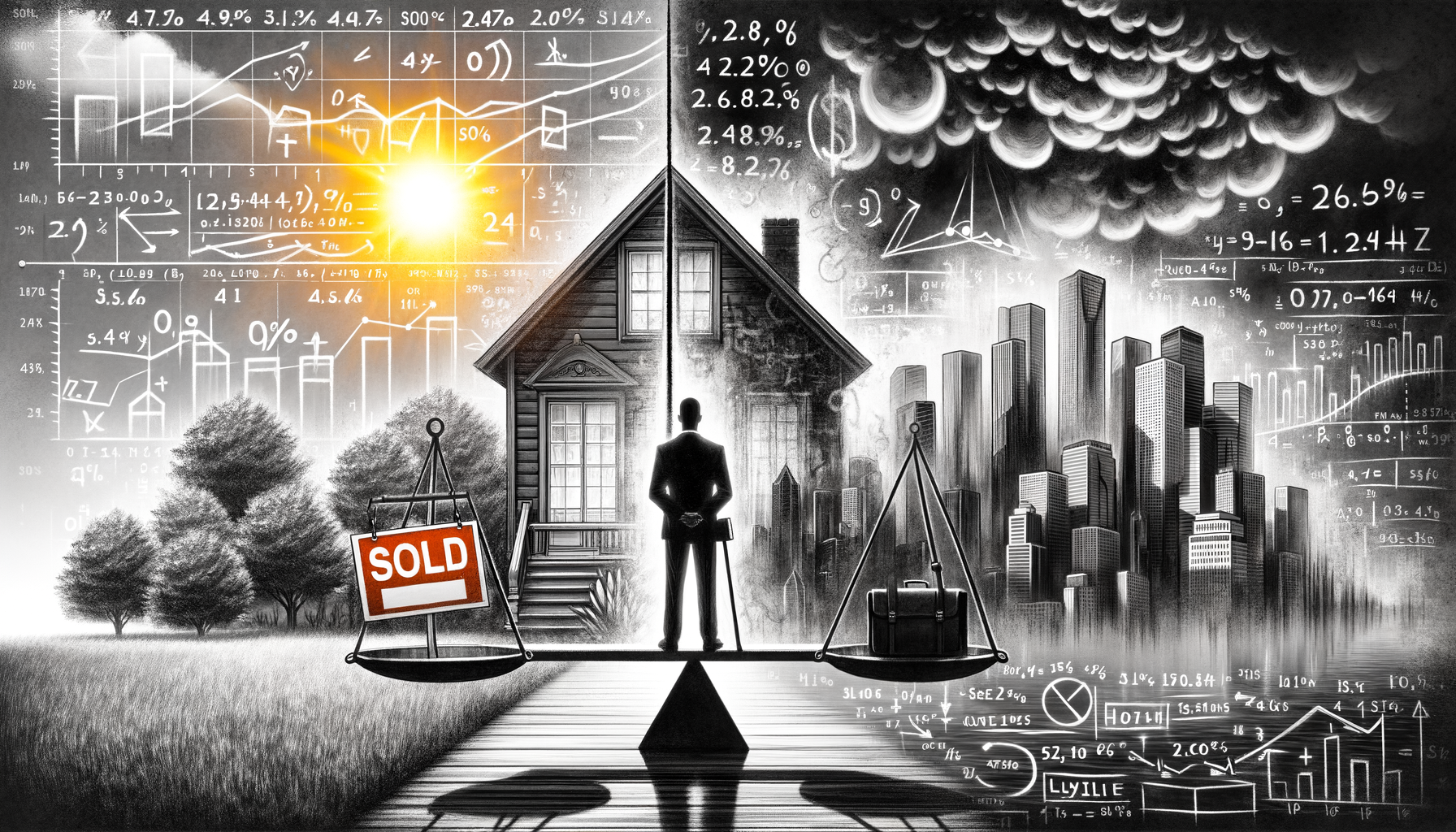

“Analyzing the Growing Disparity: Fannie Mae’s Positive Market View Vs Increasing Trader Skepticism”

The housing market landscape has experienced numerous challenging shifts over the past decade. From the housing market crash in 2008 to the current climate of concern amid the coronavirus pandemic, stakeholders, from homeowners to investors, keep their collective fingers on the pulse for what may be coming down the pike. The future of the housing market always seems to be in flux, with various market players taking different views of what may come.

Foremost among these spectators is Fannie Mae, a government-sponsored entity responsible for lending stability and affordability in the housing market. As of late, the organization has been putting forth a more positive outlook on the property market future. Yet, despite this optimistic stance from a significant player, doubt still lingers amongst traders and other stakeholders.

The Lens of Fannie Mae

Fannie Mae, officially the Federal National Mortgage Association, is invariably a considerable force in the American housing market. The organization’s primary function is to provide liquidity to the mortgage market by buying mortgages from lenders, which they then either hold in their portfolio or package as mortgage-backed securities. Their unique role as a middle ground between lenders and investors puts them in a strategic position to assess market trends.

Recently, Fannie Mae’s Economic & Strategic Research (ESR) group has painted a rosier picture of the market vista. Their analysis indicates that the headwinds once feared will impact home sales and prices negatively, have not come to fruition as expected. Now, the focus is shifting towards a normalization period in the housing market.

The findings from Fannie Mae suggest a stable environment where housing demand matches supply. The anticipation is for fewer bidding wars and overinflated house prices. The uncertainty shrouding the market scene earlier seems to be dissipating, signalling a potential return to pre-pandemic conditions, if not better.

In this detailed outlook, they expect 6.7 million sales in 2022, with median house prices rising by 7.4%. To put it in perspective, this translates to a compound annual growth rate of 4.8% for five years in a row. The organization forecasts lower but positive housing starts in the coming years, indicative of an ongoing expansion in the housing market at a slower pace.

Nonetheless, Fannie Mae has also highlighted potential risk factors that could sway the market trajectory. These include rising mortgage rates due to possible inflation and higher demands for homes from older millennials who are growing their families and hence their housing needs.

Despite the Upswing, Skepticism Awaits

Even with the promising outlook from Fannie Mae, some traders and housing market participants harbor skepticism. Their concerns primarily stem from the potential rise in interest rates, the omnipresent threat of inflation, and the anticipated slowdown in housing activity.

A small but persistent rise in mortgage rates is poised to push up borrowing costs and soften housing demands, leading to slower home sales and reduced price growth. Consequently, this could affect mortgage revenue for financial institutions and, in turn, the broader financial landscape.

On top of the mortgage rates, the general economic outlook is tinged with concerns of inflation, which could exacerbate the worries further. The U.S. economy is experiencing inflationary pressures, with consumer prices increasing at an annual rate of 6.8% in November, according to the U.S. Bureau of Labor Statistics. This rise in cost has the potential to cool off the housing market, leaving traders feeling jittery about the impact on their investments.

Adding fuel to this collective apprehension is the potential slowdown in activity within the housing market itself. Traditionally, the market experiences a natural cycle of upturns and downturns, and some believe we may overreach the peak and head for a slump.

The question of whether the current pace of home sales and growth can continue unabated for another year remains highly debatable. Some market observers see the current climate as too volatile in the wake of boosted pandemic-era demand, warning of a potential correction phase where things begin to settle down.

The lingering fears about volatility and an unpredictable future are feeding skepticism among traders and other market participants – undermining the rosier outlook painted by Fannie Mae. With risks of inflation and higher mortgage rates, coupled with uncertainties over government housing policies and changing demographics, the consensus is far from clear about where the housing market will head.

Conclusion

The housing market’s trajectory is always a topic of much contention and debate, especially since it’s a sector that deeply influences and is influenced by various aspects of the economy. With organizations like Fannie Mae presenting an optimistic view, there is room for hope. However, the tempering voices of skeptics serve as a reminder of the delicate dance of factors that make long-term prognosticating a challenging endeavor.

In summary, whether one subscribes to the more optimistic outlook presented by Fannie Mae or sides with more skeptical traders, the future of the housing market will invariably depend on a host of factors, including but not limited to interest rates, inflation, demographic changes, supply and demand trends, and broader economic health.

Therefore, all stakeholders in the housing market, from homeowners to investors, need to keep a careful eye on these elements. One thing’s for sure: the housing market will continue to evolve, and those who stay informed and adaptable, ready to adjust their strategies as trends shift, will be in the best position to thrive, whatever the future may bring.