As the year 2023 unfolds, the housing industry has witnessed some remarkable changes. Home prices across the United States have been experiencing a seismic shift, outdoing the modest growth rates seen in previous years. With a plethora of factors in play, from economic indicators and supply and demand to interest rates and demographic trends, the fluctuation in home prices paints a fascinating picture of the real estate landscape.

Across the diverse and dynamic U.S. housing market, several standout locations have exhibited exceptional increases in home prices. Here we delve into the story of 2023’s real estate success stories, exploring where home prices soared, what’s driving this upward pressure, and what implications this may hold for potential homebuyers or real estate investors.

Stateside Snapshot: Strong Growth Across the Board

Across America, the picture painted by real estate statistics this year has been an uplifting one. The housing market has retained buoyancy in light of the volatile economic environment. Highlighted by encouraging increases in average home prices and steady demand, the housing market has showcased its resilience through continued positive growth.

One trend observed in 2023 is the ascent of previously under-the-radar locales, featuring prominently in the list of places with the greatest home price growth. This unexpectedly robust growth in certain areas could be attributed to various reasons, from the affinity for remote working conditions, affordability concerns in traditionally high-priced markets to shifts in demographic preferences.

Spotlight on High-Flying Regions

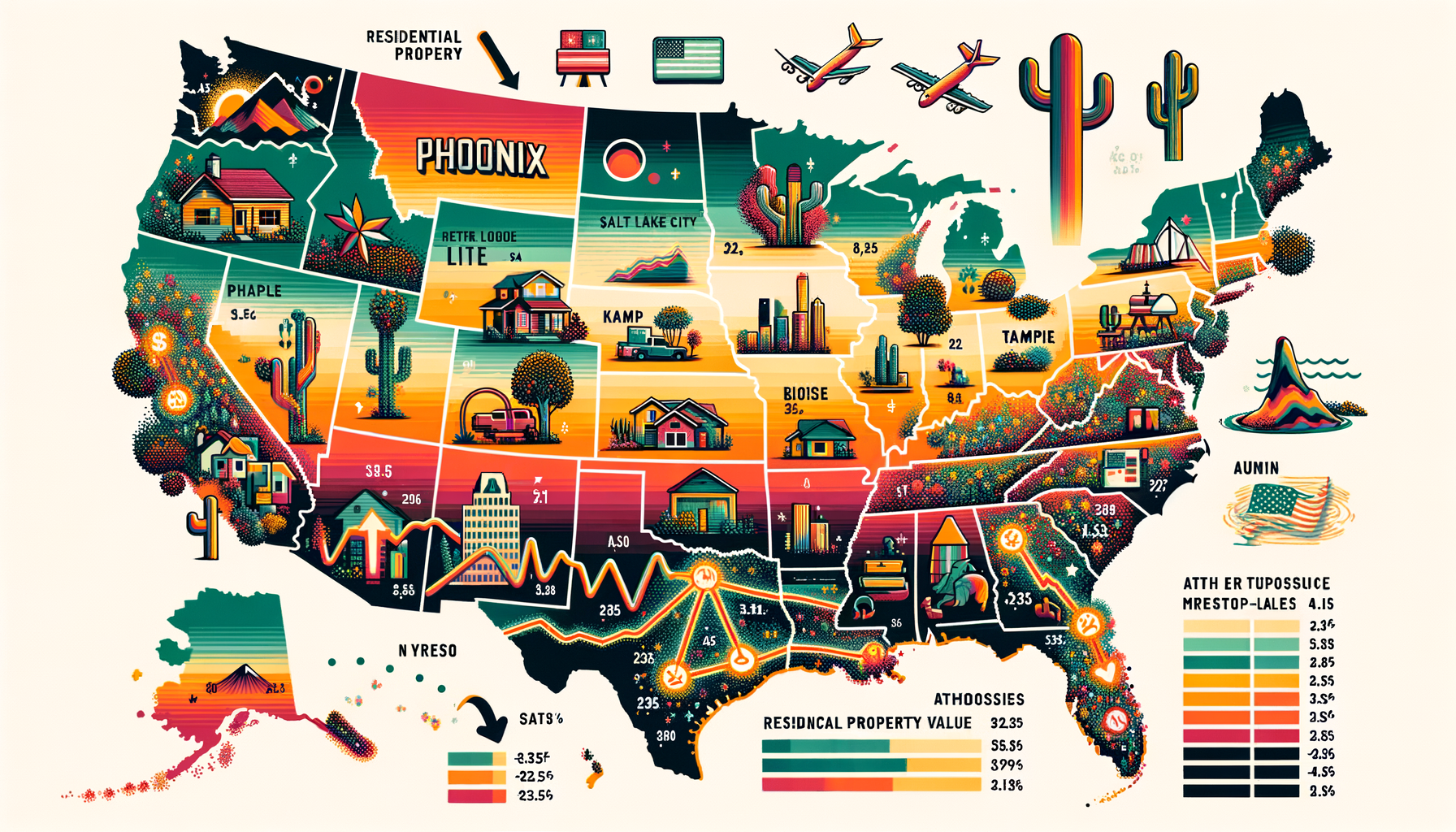

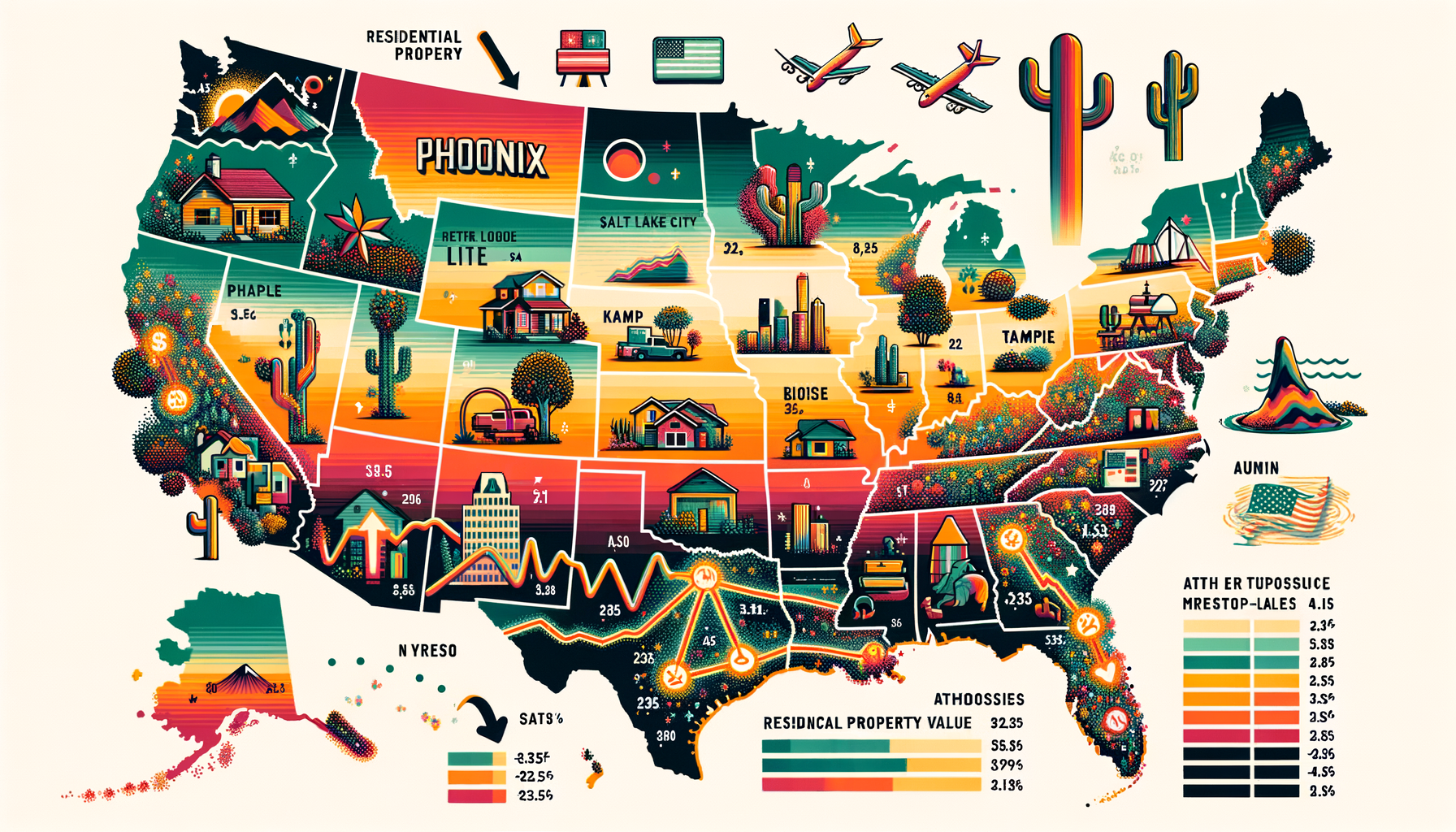

Among the high performers of the year, we find an amalgam of both rapidly growing urban centers playing host to high-tech industry growth and quieter, more residential markets offering an enticing quality of life. Some of the regions distinguished with the highest home price growth are:

1. Phoenix, Arizona: Phoenix, the capital of Arizona, has witnessed scorching growth. Rooted in a potent combination of robust job growth, a burgeoning population, and insufficient housing supply, the city’s housing market has been a hotbed of activity.

2. Salt Lake City, Utah: Another city marking substantial price growth is Salt Lake City, illustrative of the increasingly widespread exodus away from coastal metropolises. The city offers an attractive mix of affordability, access to outdoor recreation and professional opportunities, and has become a magnet for both homebuyers and companies relocating from more congested areas.

3. Tampa, Florida: Tampa has long been a popular choice for retirees, but of late, it has seen a spurt in home prices owing to increased migration, driven by its attractive climate, relative affordability, and job opportunities.

4. Boise, Idaho: Idaho is perhaps a surprise package, with Boise emerging as a standout performer. The explosion in home prices here follows a period of massive population growth, driven by the influx of out-of-state migrants seeking more affordable housing and a desirable quality of life.

5. Austin, Texas: No stranger to accolades, Austin has emerged as another city experiencing significant price growth. Home to a thriving tech scene, rich culture, and an attractive cost of living, Austin continues to attract droves of new residents, leading to skyrocketing housing prices.

Key Factors Driving the Surge

Several intertwined factors have influenced the rising housing prices across these high-performing locales. Here’s a brief review of some key influences:

1. Low Housing Inventory: The acute shortage of available homes for sale has been a significant factor in the surge in home prices. Limited supply, in the face of growing demand from buyers, has contributed to a fiercely competitive market, inflating housing prices.

2. Inter-State Migration: Shifts in population dynamics, particularly inter-state migration, have dramatically affected housing prices. People relocating from pricier coastal cities to more affordable inland states have brought with them heightened housing demand, thereby influencing home prices.

3. Remote Work Culture: The ongoing trend of remote work has given individuals the flexibility to choose where they live, leading to increased housing demand in relatively affordable, quality-of-life-rich locales that were previously overlooked in favor of traditional job hubs.

4. Low-interest rates: Favorable lending conditions, characterized by historically low interest rates, have encouraged many potential buyers to act, intensifying demand.

Looking Forward

While the past year has seen substantial growth in housing prices in certain markets, what does this mean for potential buyers and investors? Well, as markets continue to heat up, buyers might face stiffer competition and higher prices. On the other hand, for savvy real estate investors, these high-growth markets could present an optimal opportunity to diversify their portfolio and generate handsome returns, especially in the rental markets.

However, there’s an incumbent need for due diligence. The potential for overvaluation, increased sensitivity to interest rate fluctuations, and future affordability are all issues that warrant close attention.

The year 2023 demonstrated the reality of flux in the real estate market. As the narrative continues to evolve, it is integral to stay ahead of the curve and keep a keen eye on developing trends. So, whether you’re looking to buy your dream home or invest in residential real estate, the key to success lies in knowledge, patience, and strategic decision making.