“Unlocking Real Estate Success: The Power of BRRRR Method Explained”

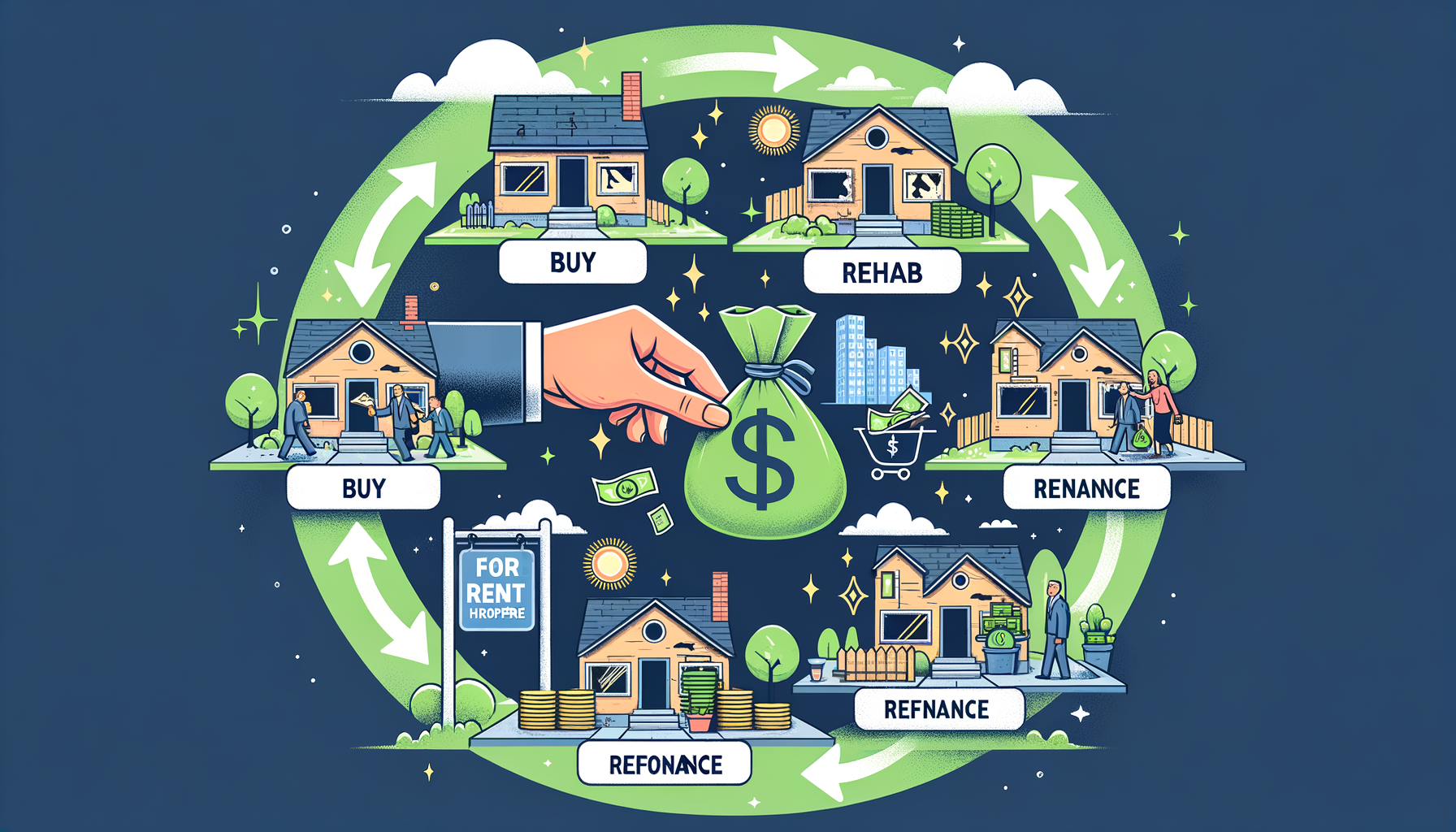

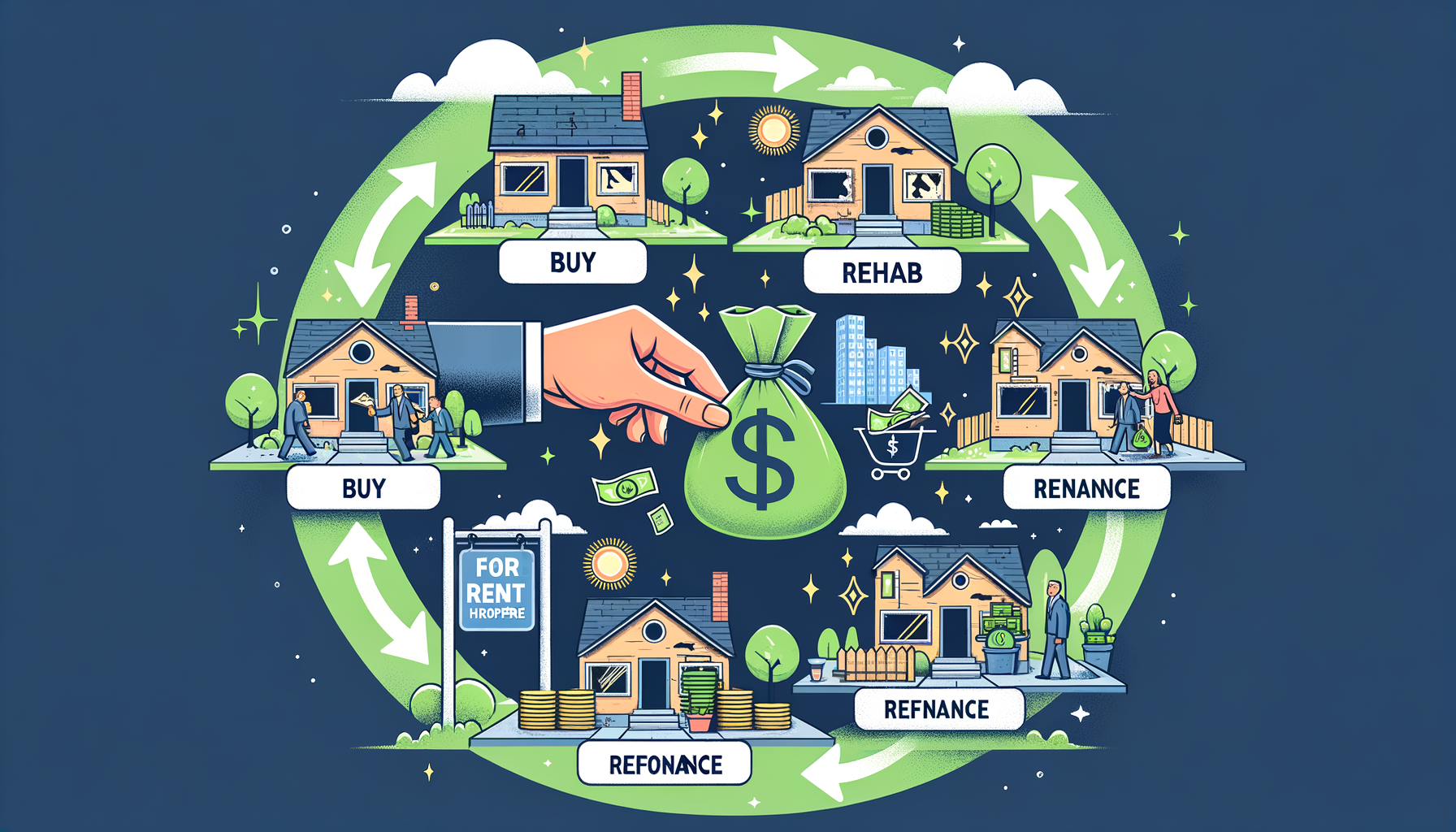

When it comes to investing in real estate, finding a successful strategy that suits one’s specific goals, resources and risk tolerance is key. By employing strategic real estate investment techniques, you can indeed pave your way to financial freedom. One such method that has gained popularity over the years is the BRRRR method. This acronym stands for Buy, Rehab, Rent, Refinance, Repeat. As the sequence suggests, this method involves purchasing a property below market value, renovating it, renting it out, refinancing it, and repeating the process.

So why is so much buzz made about the BRRRR method? Simply put, it’s an efficient and potentially profitable approach to property investing that can accelerate an individual’s path to building a considerable real estate portfolio. Let us break down this method and examine how it can turn a win-win situation for the investor.

**Buy**

The first step in the BRRRR method is to buy a property. But not just any property will do. The goal here is to look for properties that are undervalued or priced below market value—perhaps due to disrepair, neglect, or motivated sellers looking to make a quick sale. By purchasing at a discounted rate, you are setting yourself up for potential profit further into the process.

This step assumes that you have done your due diligence in doing research on the local real estate market, understanding the potential risks involved, and assessing the property’s repair needs. In most cases, investors use short-term financing such as private or hard money loans, or personal finance to take over the property.

**Rehab**

Investors then focus on rehabbing or renovating the property. The magnitude of these renovations depends on the initial condition of the property. In most cases, you’re aiming to bring it up to, if not above, the standard of the surrounding neighborhood. Remember, your renovation efforts should appeal to potential renters.

Adding value through renovation does two things. Firstly, it makes the property enticing to potential renters or buyers. Second, it boosts the value of the property when refinancing. This part of the process may require an extensive understanding of home improvement cost estimates, keen project management skills, and the wisdom to know when to outsource or DIY. Be wary of over-improving; the aim is to make the property appealing and functional, not to make it the most luxurious one in the neighborhood.

**Rent**

After rehab, the next step is to find tenants for the property. Renting out the property serves two main purposes: It provides a steady stream of income, and it gives the property a history of income generation—known as seasoning—which can be valuable when it’s time to refinance.

When setting the rental price, consider the cost of your mortgage, taxes, and operation & maintenance, while also checking comparable rents in the local market to remain competitive. Effective tenant management is critical at this stage. Ensure you screen tenants thoroughly to mitigate the risk of late payments or property damage.

**Refinance**

Once the property is rented and generating income, it’s time to refinance—another critical step. Usually, after six months of steady rental income, you can approach a bank or other lending institution to refinance the property. The goal here is to pay off any and all initial financing used to purchase and rehab the property, ideally getting a loan with a lower interest rate.

Remember, when the bank appraises your property for refinance, they’re looking at its improved value- the result of your savvy purchasing and renovation efforts. A successful refinance could mean walking away with a loan that’s more than what you initially invested, essentially getting back the money you have put in, allowing you to recover your investment.

**Repeat**

After refinancing, you should have recovered most, if not all, of your initial investment, plus you now own a cash-flowing rental property. Here is where the true magic of the BRRRR strategy comes to play – The cycle restarts. You can use the funds from the refinanced loan to repeat the process, allowing you to grow your real estate portfolio over time.

The beauty of the BRRRR method is how it allows you to effectively recycle your money. Instead of tying up your capital in a property for a substantial amount of time, you get to leverage it repeatedly across multiple properties.

**Why does BRRRR work?**

1. **Wealth Accumulation**: With each iteration, the BRRRR method lets you accumulate more properties while utilizing the same initial investment.

2. **Leveraging Debt**: Leverage is the ability to utilize borrowed funds to boost potential returns. It allows you to control more property than you could if purchasing outright with cash.

3. **Value Addition**: The rehab stage not only makes the house rent-ready but also increases its market value, potentially leading to immense profit over time.

4. **Cash Flow**: Through strategic renovation and refinancing, the BRRRR method can generate a positive cash flow through rent, which is a steady stream of income at your disposal.

5. **Stability**: If done correctly, using the BRRRR method can lead you to have a portfolio of properties providing steady cash flow, thereby creating overall financial stability.

**Potential Risks**

Real estate investing is not without risks, and the BRRRR method is no exception. A few things to bear in mind are:

\- **Market Fluctuation**: Property values and rental rates can vary greatly based on the market situation. Always do thorough research before making any decisions.

\- **Unforeseen Costs**: Rehab projects can often exceed the initial cost estimation. Always factor in a contingency budget for these unexpected expenses.

\- **Tenant Issues**: Delays in rent payments or property damages by tenants can badly strain your cash flow situation. Proper tenant screening is crucial.

\- **Requirements for Refinancing**: Most banks have specific requirements including seasoning period, creditworthiness, and Debt-to-Income ratios for refinancing. It’s vital to understand these and plan accordingly.

By understanding the potential risks and how to mitigate them, you can turn the BRRRR method into a real estate investing powerhouse, allowing you to build and grow your real estate portfolio successfully. So, whether you’re just starting your real estate investment journey or already a seasoned pro looking to step up, the BRRRR method may just be the strategic weapon you need in your arsenal.